The 9-Minute Rule for G. Halsey Wickser, Loan Agent

Table of ContentsThe 4-Minute Rule for G. Halsey Wickser, Loan AgentThe Best Strategy To Use For G. Halsey Wickser, Loan Agent10 Easy Facts About G. Halsey Wickser, Loan Agent DescribedThe Buzz on G. Halsey Wickser, Loan AgentThe Only Guide for G. Halsey Wickser, Loan Agent

The Support from a home loan broker doesn't finish as soon as your home loan is protected. They offer ongoing support, helping you with any kind of concerns or issues that emerge throughout the life of your car loan - california mortgage brokers. This follow-up support makes certain that you stay satisfied with your mortgage and can make enlightened decisions if your monetary circumstance changesSince they work with multiple lending institutions, brokers can find a financing item that matches your special economic situation, even if you have been rejected by a bank. This adaptability can be the secret to opening your desire of homeownership. Choosing to deal with a home mortgage expert can transform your home-buying trip, making it smoother, much faster, and more economically advantageous.

Discovering the appropriate home for on your own and figuring out your budget plan can be exceptionally stressful, time, and money-consuming - Mortgage Broker Glendale CA. It asks a great deal from you, depleting your power as this task can be a job. (http://www.salespider.com/p-26024404/g-halsey-wickser) An individual that functions as an intermediary between a customer an individual seeking a home mortgage or home mortgage and a loan provider typically a financial institution or lending institution

5 Easy Facts About G. Halsey Wickser, Loan Agent Shown

Their high degree of experience to the table, which can be critical in helping you make informed decisions and inevitably accomplish effective home financing. With rate of interest fluctuating and the ever-evolving market, having actually somebody fully tuned in to its ongoings would certainly make your mortgage-seeking process a lot easier, alleviating you from browsing the struggles of completing documentation and executing heaps of study.

This lets them supply professional advice on the ideal time to secure a home mortgage. Due to their experience, they additionally have established connections with a substantial network of loan providers, varying from major financial institutions to customized mortgage companies.

With their sector knowledge and ability to bargain successfully, home mortgage brokers play a pivotal function in safeguarding the best home loan bargains for their customers. By preserving connections with a varied network of lending institutions, mortgage brokers acquire accessibility to numerous home mortgage alternatives. Their enhanced experience, explained above, can provide important information.

G. Halsey Wickser, Loan Agent - Questions

They have the skills and strategies to convince loan providers to offer better terms. This might include lower rate of interest, minimized closing costs, or also extra adaptable payment schedules (G. Halsey Wickser, Loan Agent). A well-prepared home mortgage broker can provide your application and financial account in such a way that attract lending institutions, increasing your opportunities of a successful arrangement

This advantage is usually a pleasurable surprise for many buyers, as it allows them to take advantage of the competence and resources of a home loan broker without bothering with sustaining added expenses. When a debtor protects a home mortgage through a broker, the lending institution compensates the broker with a compensation. This commission is a portion of the car loan quantity and is typically based on aspects such as the rates of interest and the kind of lending.

Mortgage brokers stand out in recognizing these distinctions and working with loan providers to find a mortgage that matches each customer's specific needs. This tailored approach can make all the distinction in your home-buying trip. By functioning closely with you, your mortgage broker can ensure that your loan terms straighten with your economic goals and capabilities.

The Single Strategy To Use For G. Halsey Wickser, Loan Agent

Customized home loan solutions are the secret to a successful and lasting homeownership experience, and home loan brokers are the specialists who can make it take place. Hiring a home mortgage broker to function together with you might result in quick financing approvals. By using their expertise in this area, brokers can help you stay clear of potential challenges that usually create delays in funding authorization, bring about a quicker and a lot more efficient path to protecting your home funding.

When it concerns buying a home, browsing the world of home loans can be frustrating. With many choices offered, it can be challenging to find the right funding for your needs. This is where a can be an important source. Home mortgage brokers serve as middlemans between you and possible lenders, helping you find the finest home mortgage deal tailored to your specific circumstance.

Brokers are fluent in the intricacies of the mortgage industry and can supply valuable understandings that can aid you make notified decisions. As opposed to being limited to the home mortgage items supplied by a solitary loan provider, home mortgage brokers have accessibility to a large network of loan providers. This indicates they can look around on your behalf to locate the ideal lending options readily available, possibly conserving you time and money.

This accessibility to multiple loan providers provides you an affordable benefit when it pertains to securing a beneficial mortgage. Searching for the appropriate home loan can be a lengthy procedure. By functioning with a home mortgage broker, you can save effort and time by letting them take care of the research study and documentation entailed in finding and protecting a car loan.

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

Unlike a small business loan officer that might be handling multiple customers, a home mortgage broker can provide you with individualized service tailored to your private needs. They can take the time to understand your monetary situation and goals, supplying customized services that straighten with your details requirements. Home mortgage brokers are knowledgeable negotiators who can help you safeguard the best possible terms on your lending.

Scott Baio Then & Now!

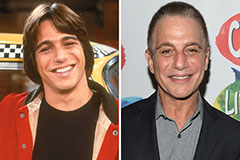

Scott Baio Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!